bain capital tech opportunities fund l.p

Bain Capital Tech Opportunities Fund LP. The Fund Seeks to Provide Long-Term Capital Growth.

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Is incorporated in the state of Cayman Islands.

. Pooled Investment Fund CIK Number. Number of Exits 1. Ad Learn How EY-Parthenon Professionals Design and Deliver Digital Investment Strategies.

Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. To view a list of current job openings at. Performance charts for Bain Capital Tech Opportunities Fund LP PE21208 including intraday historical and comparison charts technical analysis and trend lines.

Ad We offer a complete package with intuitive tools for traders who wont compromise. It is now ahead of its 1 billion target reported last October by Buyouts. Andrew Cleverdon Chief Financial Officer Senior Vice President Ventures and Tech Opportunities.

Investor Type Venture Capital. 200 CLARENDON STREET BOSTON 02116. October 2020 Number of.

Jay Corrigan Managing Director Global Private. Schedule 13GA 02142022 PDF. Review the Key Highlights from the EY-Parthenon 2022 Digital Investment Index.

Bain Capitals second Tech Opportunities fund is targeting 15 billion for investments in mid-market. Bain capital tech opportunities fund ii lp Tuesday February 22 2022 Edit. SEC CIK 0001789820.

The Bain Capital Tech Opportunities Fund LP is targeting up to 1 billion to make control and late-stage growth investments in midmarket tech deals. Bain Capital Specialty Finance Inc. City StateProvinceCountry ZIPPostalCode Phone Number of Issuer.

Rowe Price Provides Strategies Insights and Services That Put Client Needs First. Bain Capital Tech Opportunities. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15bn barely a year after wrapping up the strategys debut fund with 125bn.

Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers and late-stage minority investments. Bain Capital Tech Opportunities General Partner LLC. Is advised by BCSF Advisors LP BCSF Advisors an SEC-registered.

Bain Capital Tech Opportunities is a growth investment firm that seeks to invest in the application software infrastructure and security fintech and payments. Investment Stage Early Stage Venture Late Stage Venture. Ad Learn How EY-Parthenon Professionals Design and Deliver Digital Investment Strategies.

Street Address 1 Street Address 2. Review the Key Highlights from the EY-Parthenon 2022 Digital Investment Index. Fund 2009 raised 467 million.

Get specialized trading support with people who know the markets share your passion. Bain Capital Tech Opportunities was created in 2019 to make investments in technology companies particularly in enterprise software and cybersecurity. Bain Capital Tech Opportunities Fund Overview Update this profile Fund Type.

The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David Lee the director of. For financial reporting their fiscal year ends on December 31st. Athenahealth Healthcare Technology Leader to be Acquired by Hellman Friedman and Bain Capital for 17 Billion PORTFOLIO NEWS MAY 23 2022 athenahealth Names John Hofmann.

Bain Capital Tech Opportunities founded in Boston. Bain Capital Tech Opportunities pursues investments in application software fintech and payments healthcare IT and infrastructure security. Carta Securities LLC Brown Brothers Harriman Co.

Bain Capital Tech Opportunities Fund LP. Credit October 2019. Form 40-17G 04122022 PDF.

1 day agoInsigneo Financial Group will receive a 100 million minority investment from Boston-based Bain Capital Credit and New York City-based JC. Bain Capital Tech Opportunities Fund LP. Inception of Bain Capital Senior Loan Fund LP SLF Venture November 2009.

Bain Capital Tech Opportunities aims to help growing technology companies reach their full potential. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates. Bain Capital Tech Opportunities Fund secured 107 billion according to a Form D fundraising document.

The Bain Capital Tech Opportunities Fund LP is targeting up to 1 billion to make control and late-stage growth investments in midmarket tech deals. Bain Capital Tech Opportunities.

Bain Capital Tech Opportunities General Partner Llc

Swati Mital Bain Capital Private Equity

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

News Bain Capital Tech Opportunities

About Us Bain Capital Private Equity

Bain Capital Credit Likes Nimble Mid Market Companies That Don T Ebb And Flow With The Economy Private Debt Investor

Bain Capital Tech Opportunities Fund Ii Profile Investments Returns Pitchbook

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

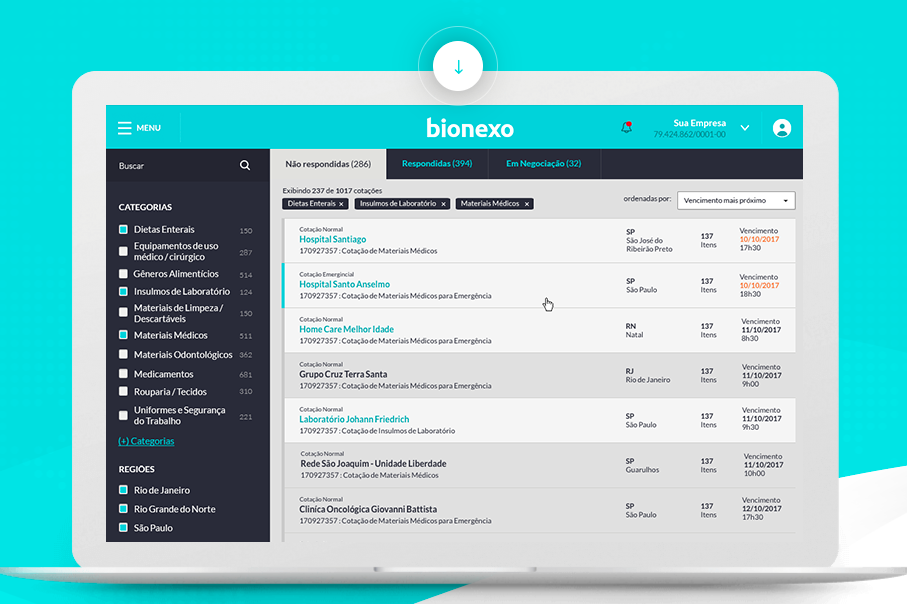

Bionexo Announces R 450 Million Investment From Bain Capital Tech Opportunities Bain Capital

Industries Bain Capital Private Equity

Bain Capital Targets 1 5bn For Second Tech Opportunities Fund Private Equity Insights

Athenahealth Acquired By Hellman Friedman And Bain Capital Business Wire